ERISA Audit Requirement Frequently Asked Questions

If you sponsor an employee benefit plan subject to Title I of ERISA, you are subject to annual reporting requirements that may include an audit of the plan's financial statements. Some of the questions we hear most frequently about this requirement are addressed below.

- What types of plans aren't subject to Title I of ERISA (and therefore don't have an annual reporting obligation)?

-

Governmental plans and church plans are exempt from Title I of ERISA. Certain 403(b) plans that qualify under the safe harbor rules are also exempt (see our 403(b) page for further discussion). You should consult with ERISA counsel if you think your plan might not be subject to Title I, as failure to comply if subject can bring harsh penalties.

- Does my ERISA-covered employee benefit pension plan need an audit?

-

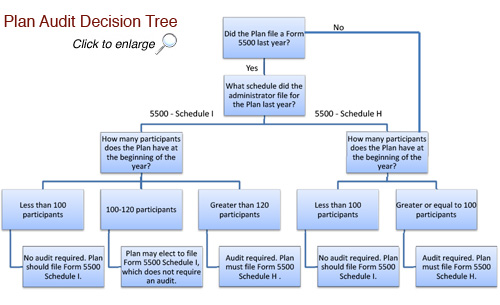

Different rules apply depending on whether your plan is classified as a "small" plan or a "large" plan. Generally, a small plan must file Schedule I with its Form 5500 Annual Report, and no audit report is required. (However, see the discussion at the DOL's website for small pension plans with non-qualifying assets). A large plan must file Schedule H with its Form 5500 Annual Report, and Schedule H requires disclosure of information on the auditor and the attachment of an auditor's report; in other words, it requires an audit to be performed.

The general rule is that plans with more than 100 participants at the beginning of the plan year are "large" plans, needing an audit. (Please see further discussion below on welfare benefit plans).

However, there is a major exception to this rule, called the "80-120 rule." This rule is often misapplied. For assistance in understanding it, please see the decision tree above. If the plan was in existence in the previous year, was treated as a small plan for that year (filed Schedule I with the Form 5500), and has no more than 120 participants as of the beginning of the plan year, it may continue to file as a small plan, and no audit will be required. There is no limit to the number of years this rule may be applied. This means a plan may have up to 120 participants for many years without having an audit requirement.

If a plan is new and there was no previous Form 5500 filing, it must file as a large plan if it has over 100 participants at the beginning of the year, and an audit would be required. For first-year 403(b) audits, you may go through an "as if" analysis to determine what schedule the plan would have filed in the previous year if it had been required to do a full filing, and apply the 80-120 rule "as if" the plan had made a complete 5500 filing in the previous year.

If a plan has been filing as a large plan, the number of participants must drop below 100 before it may file as a small plan again.

- What does the "80" piece of the "80-120" rule mean?

-

Far less popular in application, this part of the rule provides that if a plan was treated as a large plan in the prior year (filed Schedule H with the Form 5500) and the number of participants in the plan has dropped below 100, it may elect to continue filing as a large plan as long as it has over 80 participants. Most plan administrators choose to file as a small plan when they can to avoid the expense of an audit.

- Who is a participant for purposes of these counts?

-

Effective January 1, 2023 the Department of Labor has made a change to the participant count methodology for the Form 5500 filings. Per the DOL Fact Sheet regarding this change, "The counting methodology for defined contribution retirement plans will be based on the number of participants with account balances, rather than the current method that counts individuals who are eligible to participate even if they have not elected to participate and do not have an account in the plan."

The participant count as of the beginning of the year determines whether an audit is required for the plan year, not the last day of the previous plan year. Plans with over 100 participants generally require an audit; however, if your plan has between 80 and 120 participants, see the link above for the 80-120 rule. As a result of this change in how participants are counted, your plan may no longer require an audit. If your plan has low participation, we recommend you contact your recordkeeper or third-party administrator to review whether your plan requires an audit.

- Does my welfare benefit plan need an audit?

-

Welfare benefit plans such as medical, dental, short and long-term disability and the like do not require audits unless they are funded. Often, these benefits are instead paid out of the general assets of the employer/plan sponsor, or through insurance. Please see this welfare plan audits flowchart (PDF) from the DOL for assistance in determining whether your welfare benefit plan is funded, and whether it has an audit requirement.

If the plan uses a VEBA trust it will be considered a funded plan, and an audit will be required if there are 100 or more participants.

In the case of a plan where employees contribute some of the premium costs, the appropriate use of a section 125 plan for employee contributions may enable a self-funded welfare benefit plan to be treated as an unfunded plan. You should consult with an expert to be sure you are appropriately handling employee contributions.

- Who is a participant for purposes of these counts in a welfare benefit plan?

-

When counting participants in a funded welfare benefit plan, you do not need to count eligible employees who elect not to participate in the plan. Nor do you count spouses and beneficiaries of participating employees. You do count employees and retirees receiving medical benefits under the plan.

- What is the end product in an employee benefit plan audit?

-

The end product is a set of audited financial statements for the Plan, complete with the auditor's opinion, footnote disclosures and supplemental schedules required under ERISA. These financials will be included with the Plan's Form 5500 filing.

- What types of areas will be covered in an audit of the plan?

-

Auditors will use their judgment to determine the nature and scope of audit tests to be performed, based on their knowledge of the Plan's control environment, nature of the Plan and other factors. In general, audits of employee benefit plans will address the following areas:

- Contributions to the plans – both employee and employer

- Distributions from the plan

- Participant loans from the plan

- Expenses paid by the plan

- Plan investments and income

- Participant data

- Tax compliance and related party transactions

- When must the audit be completed?

-

The audit must be completed in time for the audit report to be attached to the Form 5500, so it is subject to 5500 filing deadlines. The 5500 is due seven months after the last day of the plan year, or July 31 for calendar year-end plans, and may be extended for an additional 2½ months, to October 15 for calendar year-end plans.

- Is there a special rule for short plan years?

-

If there is a short plan year of seven months or fewer, regulations provide that the audit for the short plan year may be deferred until the following plan year. The plan audit for the short plan year still needs to be performed, however the audit report is filed with the following year's Form 5500 instead of the short year's Form 5500. Of interest, if this election is made and the plan participant count falls under 100 for the subsequent plan year, the plan must still meet the large plan filing requirements in that subsequent year.

- How much time should I allow to complete the audit?

-

Although it may be possible to complete a quality audit in less time, it is desirable to begin the audit at least two to three months prior the due date, to allow time to plan the audit, gather information, receive responses to all confirmation requests, perform fieldwork, follow up on open items, draft financial statements and wrap up. Adequate time should be left to address unforeseen problems and resolve them prior to the filing deadline. However, if you have just realized you have an audit requirement and the timing is tighter than this – give us a call! We are specialists in performing audits under deadline and will make every effort to meet yours.

Limited Scope Audit Frequently Asked Questions

- What is a limited scope audit?

-

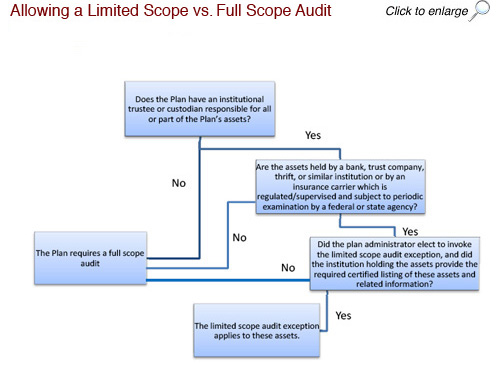

A limited scope audit allows a plan to have an audit where the auditor may rely on the certification of an institutional asset trustee or custodian to limit the scope of testing on any investment information. It is of primary importance to understand that the limited scope exception does not apply to any other audit areas, only to investments. Therefore, you should expect that your auditors will still conduct procedures in all other audit areas (for example, participant data, contributions, distributions, etc.)

- Which plans qualify to have a limited scope audit?

-

See this flow diagram to help determine whether you need a full or limited scope audit (source reference below).

If all or a part of a Plan's assets are held by a bank, insurance company or regulated trust company, the Plan may qualify to have a limited scope audit. The asset custodian or trustee must be subject to regulation by a state or federal agency and able to provide to the Plan sponsor the certification required under Department of Labor regulations 2520.103-8. Please see the flowchart.

- What if my plan has some assets with a custodian that can provide a certification, and some assets elsewhere?

-

The auditor may perform limited scope audit procedures with regard to the assets held at the certifying institution, and must perform full scope audit procedures for the other assets.

- How will the auditor's report read if we have a limited scope audit?

-

Instead of rendering an opinion, the auditor's report will disclaim an opinion due to the significance of the information that they did not audit. This will not have any adverse consequences, as a disclaimer under these regulations is acceptable to the Department of Labor.

- What if my plan has an 11K filing requirement?

-

A full scope audit must be performed for plans with 11K filing requirements, as the SEC will not accept a limited scope audit.

References

The decision flow diagrams on this page are adapted from the AICPA, "AAG - Employee Benefit Plans, With Conforming Changes as of March 1, 2005," AICPA Paperbound Product #012595, March 2005, figures 5-1, 5-2, 5-3, and 5-4, pages 69 - 73. Copyright © 2005, AICPA. Reprinted with permission.Employee benefit plan audits of:

- 11-K Audits

- 401(k) plans

- 403(b) plans

- Other 401(a) plans

- Money purchase pension plans

- Defined benefit pension plans

- Cash balance pension plans

- ESOPs

- Other hybrid plans

- Funded welfare benefit plans

ERISA consulting and other employee benefit plan services:

Form 5500 preparation and review

Employee benefit plan tax services, including preparation of Forms 8955-SSA, 5330, 990, 990-T

Representation in DOL and IRS examinations

Consulting in ESOP formation and transactions

Assistance in correcting problems involving late filings, plan administration and design, including self-corrections and submissions to the DOL and IRS under established correction programs (DFVCP, VFCP and EPCRS)

Assistance with the RFP process to find plan service providers